FICO Credit Score Stalls Out @ 760: What A Buzzkill!

Nothing exciting to report this time.

My FICO® credit score recently updated, and, as I expected, my FICO score didn't budge and is still at 760. Though I was expecting no change, I had gotten hooked on watching my score rise each month, so the fact that my score has leveled off is...well...a buzzkill!

Why no rise this time around? Well, it's quite simple: I didn't make a sizeable payment on my Citibank credit card last month (my Citibank card is the only consumer credit card I have with a balance right now. I have a balance on two business credit card accounts, but payments to those account don't affect my FICO score.) I've had to shift my priorities a bit as I prepare to live alone again, which will happen in about two months.

What does a 760 FICO score mean? For what I've learned, it means that I'm a 2% credit risk in the eyes of Fair Isaac (750 -799 range.) 800 or higher translates to a 1% risk of default, while a score between 700 and 749 translates to a 5% risk of default.

Here's what's really frustrating about having a 760 score: I recently learned that my car insurance company -- State Farm -- bestows their customers with the coveted "top tier" rank once an insured driver's FICO score rises above the 770 mark. So I'm a mere 10 points away from getting the best possible deal on car insurance! Bah! Jut doesn't seem fair. You can bet the shirt on your back that my insurance agent will be getting an urgent call from me just as soon as my score crosses the 770 threshold. Yep.

I need a new buzz, a new fix. In order to get the 11 point jump I desire, I think I'll need to make a payment of at least $500 on my Citibank credit card. I have no idea how I'm going to squeeze it out of my budget right now, but I'm sure I'll think of something.

That's it for now. I'll report again on my FICO-related adventures next month. Stay tuned!

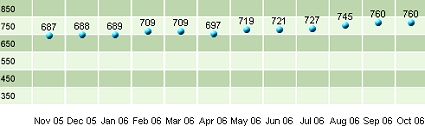

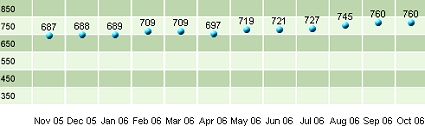

As is the tradition at this particular debt blog, here's an updated image of my charted credit score:

My FICO® credit score recently updated, and, as I expected, my FICO score didn't budge and is still at 760. Though I was expecting no change, I had gotten hooked on watching my score rise each month, so the fact that my score has leveled off is...well...a buzzkill!

Why no rise this time around? Well, it's quite simple: I didn't make a sizeable payment on my Citibank credit card last month (my Citibank card is the only consumer credit card I have with a balance right now. I have a balance on two business credit card accounts, but payments to those account don't affect my FICO score.) I've had to shift my priorities a bit as I prepare to live alone again, which will happen in about two months.

What does a 760 FICO score mean? For what I've learned, it means that I'm a 2% credit risk in the eyes of Fair Isaac (750 -799 range.) 800 or higher translates to a 1% risk of default, while a score between 700 and 749 translates to a 5% risk of default.

Here's what's really frustrating about having a 760 score: I recently learned that my car insurance company -- State Farm -- bestows their customers with the coveted "top tier" rank once an insured driver's FICO score rises above the 770 mark. So I'm a mere 10 points away from getting the best possible deal on car insurance! Bah! Jut doesn't seem fair. You can bet the shirt on your back that my insurance agent will be getting an urgent call from me just as soon as my score crosses the 770 threshold. Yep.

I need a new buzz, a new fix. In order to get the 11 point jump I desire, I think I'll need to make a payment of at least $500 on my Citibank credit card. I have no idea how I'm going to squeeze it out of my budget right now, but I'm sure I'll think of something.

That's it for now. I'll report again on my FICO-related adventures next month. Stay tuned!

As is the tradition at this particular debt blog, here's an updated image of my charted credit score:

Labels: 760, credit_score, fico

|

--> CLICK HERE TO VOTE IN THE DEBT POLL <--

|

0 Comments:

Post a Comment

Links to this post:

Create a Link

<< Home