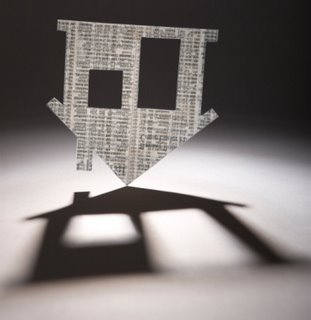

Don't Forget: There Is A 3 Year Moratorium On Tax Liability For Debt Forgiveness

On December 27, 2007, President Bush signed the Mortgage Forgiveness Debt Relief Act[1] of 2007 (HR 3648) into law.

On December 27, 2007, President Bush signed the Mortgage Forgiveness Debt Relief Act[1] of 2007 (HR 3648) into law.This law established a 3 year moratorium that prevents any debt forgiven by a lender from being counted as income by the Internal Revenue Service (IRS). Basically, if a homeowner negotiates a short sale or any other type of debt forgiveness with a lender, the homeowner will not be liable for any taxes on the forgiven debt.

For example, if a homeowner in foreclosure gets a bank to agree to take $400,000 for an original loan amount of $500,000, then the homeowner will not have to pay any taxes on the forgiven $100,000 ($500,000 minus the $400,000).

The Mortgage Debt Relief act also extends the private mortgage insurance deductions through 2010. The deduction for private mortgage insurance allows families with an adjusted gross income of $109,000 or less to deduct all or some of their premium payments.

As it stands, the Mortgage Forgiveness Debt Relief Act only applies to a primary residence. So second homes and investment properties are out. Still, even with a second home or an investment property you may not have to pay any tax on the forgiven debt, so long as you can prove to the IRS that you were insolvent at the time. Which may or may not be tough to do.

With the Mortgage Forgiveness Debt Relief Act of 2007, as long as it’s your primary residence, you don’t have to prove anything to the IRS.

If a short sale is the best option, then this is the time to negotiate one.

Labels: ademola, debt_relief, hr_3648, irs, mortgage, mortgage_debt_relief_act, mortgage_foregiveness, mortgage_relief, short_sale

|

--> CLICK HERE TO VOTE IN THE DEBT POLL <--

|

3 Comments:

This post is an excellent resource for all homeowners, especially those who know how to wheel and deal. I had no idea that you could settle with your mortgage company for less than you owe like that, but it makes perfect sense. You can settle other debts and have percentages of the amounts owed forgiven in other instances, so why not do it with a house? Any homeowner who knows his or her rights as a borrower can really take advantage of what you're talking about.

I am going to share this article. I'm always looking for new information on tax breaks and exemptions, and in this economy, this one may be particularly useful for a number of readers.

good idea... thanks for the post, especially since i am looking to buy a home in the next couple of months.

-jack

This information is priceless.

Recently, I was watching a popular personal finance TV show that features a famous personal finance guru. She talked about this, and did not mention the moratorium. Maybe it was an old show.

Post a Comment

Links to this post:

Create a Link

<< Home