Chase Cancels My WaMu Credit Card

I hadn't used my WaMu credit card since the first quarter of 2006. Back then, it was a Providian credit card. But then Washington Mutual (WaMu) bought Providian, and, just recently, Chase bought WaMu.

I hadn't used my WaMu credit card since the first quarter of 2006. Back then, it was a Providian credit card. But then Washington Mutual (WaMu) bought Providian, and, just recently, Chase bought WaMu.Now, the reason I wasn't using this card is because a) it didn't have a competitive interest rate for purchases and b) the rewards program attached to it wasn't anything special. I had plenty of cards to choose from, so why would I choose one with a high APR and a very ordinary rewards program? I used this card to take advantage of an attractive 0% balance transfer deal, then, when the interest-free period expired, I paid the card down to zero. I kept the account open because the $11,000 worth of credit available to me with this account was helping to keep my credit score high.

Another reason I liked having this account was because I had free access to my Bankcard FICO credit score (provided by TransUnion.) No other card in my wallet (and I have plenty) offered this unique benefit.

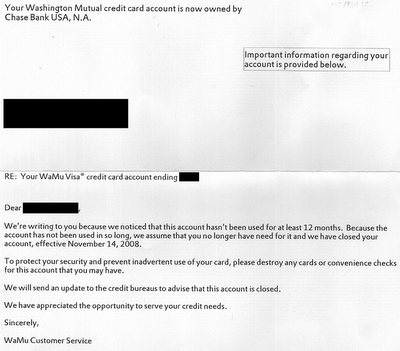

Last month, I received a letter in the mail informing me that Chase was closing my WaMu credit card account because I hadn't used it in more than 12 months. The letter was short and to the point:

I wasn't happy about this. First of all, my FICO® credit score would likely drop due to the decreased amount of credit available to me. Second, I liked having free access to my credit score. Who wouldn't?

So my first reaction was to try and use the card to see if Chase had deactivated it yet. I tried to buy a song from Amazon ($0.99) but the charge didn't go through.

Next, I called the customer service number on the back of my card. Despite the late hour, I was able to talk to a customer service representative (CSR) right away. I asked the CSR to reactivate my card. I told him that I wanted to do some Christmas shopping with it immediately (which wasn't a lie. I would have spent some money on the card to keep it open.) The CSR said he couldn't do it (listen to the MP3 audio here.) He explained that WaMu had closed 1.3 million inactive accounts. The CSR anticipated that I would complain about the negative effect this action would have on my credit score, so, before I could say anything, he went on to say that this action, "will not appear as a negative mark on your credit bureau report." I complained a bit, then he explained that because the account was closed due to inactivity, and because my account had a zero balance, I had nothing to worry about.

I did not see any point asking for a supervisor, but I did call back a few hours later (their CSR's are available 24/7) to see if I would get a consistent response to my reactivation request. The second CSR gave the same canned response to my appeal for reactivation, but also added that I could apply for a new WaMu credit card account if I wanted to (MP3 audio here.) This suggestion made sense to me even though I wasn't happy about it. The "don't worry about it" nonsense that CSR #1 gave me was insulting, because we both knew that my score will be affected. I'm just going to hope that the ding to my score is a mild one.

My credit score is 804 right now and I want it to either stay there or rise. So, should take my time and find a really great credit card and apply for it?

Having thought about it for a few seconds, I've decided to apply for another WaMu (Chase) card, because I want my credit score to stay high and I want free access to my score. According to the WaMu website, all WaMu cards still provide free access to the accountholder's FICO.

I found that I can still login to my WaMu account online, so I visited WaMu to see if they had any credit card offers ready and waiting for me. I found no offers in there.

I will try to find a good WaMu card and apply for it. I'll post again after my application is processed.

So I may end up with another WaMu credit card account after all this, which would be a silly waste of time and resources (paper, plastic, phone calls, etc.)

Labels: 0%_balance_transfer, chase, credit_cards, credit_score, fico, wamu

|

--> CLICK HERE TO VOTE IN THE DEBT POLL <--

|