Futures Market 100% Certain The Fed Will Cut Short-Term Rates Again On December 16

Former Federal Reserve Chairman Alan Greenspan has had to contend with lots of criticism for keeping the benchmark fed funds target rate (FFTR) at 1.00% for too long. The Greenspan Fed cut the FFTR to 1.00% on June 27, 2003, and kept it there until July 1, 2004. Some economists believe all that exceptionally cheap money that was sloshing around in the economy 5 years ago contributed to the financial mess we find ourselves in today.

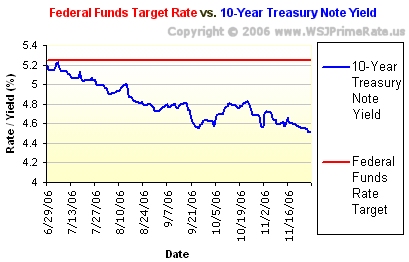

Former Federal Reserve Chairman Alan Greenspan has had to contend with lots of criticism for keeping the benchmark fed funds target rate (FFTR) at 1.00% for too long. The Greenspan Fed cut the FFTR to 1.00% on June 27, 2003, and kept it there until July 1, 2004. Some economists believe all that exceptionally cheap money that was sloshing around in the economy 5 years ago contributed to the financial mess we find ourselves in today.So now, the big question: is the Bernanke Fed willing to take the FFTR below 1.00% in an effort to stave off a long and painful recession? According to the fed funds futures market, the answer is a firm yes. The futures market is currently 100% confident that the Fed will opt to cut short-term rates again at the next Federal Open Market Committee (FOMC) meeting on December 16, with a majority in the market betting on another 50 basis point (0.50 percentage point) cut.

Here are some factors that (likely) influenced the futures market this week:

- On Tuesday, The Conference Board reported that its Consumer Confidence Index (CCI) fell to 38.0, the lowest level ever for the metric. For the CCI, the baseline "100" score is pegged to 1985 survey data.

Earlier today, the University of Michigan reported that its Consumer Sentiment Index fell from 70.3 for September to 57.6 for October. The baseline "100" score is pegged to 1966 survey data. - On Monday, the Commerce Department reported that the median cost for a newly built home fell from $220,400 for August to $218,400 during September. Click here for historical prices and a chart.

- On Thursday, the Commerce Department reported that the Gross Domestic Product declined by 0.3% during the third quarter of this year.

- Earlier today, the Commerce Department reported that consumer spending fell by 0.3% during September.

- Late this afternoon, JP Morgan Chase, the second largest bank holding company in the United States[1], announced that:

"...it is expanding its already significant mortgage modification program by undertaking multiple initiatives designed to keep more families in their homes, including extending its modification programs to WaMu and EMC customers..."

Here's another snippet from today's press release:

"...The enhanced program is expected to help 400,000 families - with $70 billion in loans - in the next two years. Since early 2007, Chase, WaMu and EMC have helped about 250,000 families - with $40 billion in loans -- avoid foreclosure, primarily by modifying their loans or payments. Both the existing and enhanced programs apply only to owner-occupied properties with mortgages owned by Chase, WaMu or EMC, or with investor approval.

Chase inherited pay-option ARMs when it acquired WaMu's mortgage portfolio last month and EMC's portfolio earlier this year as part of the Bear Stearns acquisition. After reviewing the alternatives that were being offered to customers, Chase decided to add more modification choices. All the offers will eliminate negative amortization and are expected to be more affordable for borrowers in the long term..."

As of right now, the investors who trade in fed funds futures at the Chicago Board of Trade have odds at 100% (as implied by current pricing on contracts) that the FOMC will vote to cut the benchmark Federal Funds Target Rate by at least 25 basis points (0.25 percentage point) at the December 16TH, 2008 monetary policy meeting.

Summary of the Latest Prime Rate Forecast:

- Current odds that the Prime Rate will be cut by at least 25 basis points at the December 16TH, 2008 FOMC monetary policy meeting: 100% (certain)

- NB: U.S. Prime Rate = (The Federal Funds Target Rate + 3)

The odds related to federal-funds futures contracts -- widely accepted as the best predictor of where the FOMC will take the benchmark Fed Funds Target Rate -- are constantly changing, so stay tuned for the latest odds.

Labels: JPMorgan_Chase, odds, prime_rate_forecast

| > SITEMAP < |

Nonfarm payrolls advanced by 18,000 during December 2007, according to this morning's Labor Department report. Wall Street economists were expecting around 70,000 new jobs for last month. News that the unemployment rate jumped from 4.7% to 5.0% also surprised economists, many of whom were expecting the jobless rate to come in at 4.8%.

Nonfarm payrolls advanced by 18,000 during December 2007, according to this morning's Labor Department report. Wall Street economists were expecting around 70,000 new jobs for last month. News that the unemployment rate jumped from 4.7% to 5.0% also surprised economists, many of whom were expecting the jobless rate to come in at 4.8%.