|

|

||

|

|

||

| Budgeting

and Rates: A Guide for Students and Young People |

||

|

|

||

|

||

|

When you’re a student or someone just starting out in life, managing money can feel like trying to juggle flaming torches while riding a unicycle. It’s challenging, overwhelming, and often confusing. But it doesn’t have to be that way! Budgeting and understanding rates (the prices you pay for goods and services) are essential skills that can help you live more comfortably and avoid unnecessary stress. In this guide, we’ll break down the fundamentals of budgeting and rates, focusing on the things you need to know as a student or young person just stepping into the world of personal finance. Whether you're living on a tight student loan or starting your first part-time job, these tips will help you get your finances under control. Why Budgeting Is Crucial for Students and Young People Have you ever found yourself broke by the end of the month, wondering where all your money went? You’re not alone! A lot of young people find themselves in the same boat. Without a proper budget, it’s easy to lose track of your spending and end up in a financial mess. Budgeting gives you the clarity to see where your money goes and how you can make it work for you. Think of a budget like a map. If you want to get to your destination (financial stability), a map helps you avoid getting lost or stuck in detours. With a budget, you can track your expenses, save for the things that matter, and avoid falling into debt. Key Components of a Budget When setting up a budget, there are a few key components you need to keep in mind:

Once you’ve figured out these categories, you’ll be able to allocate your money efficiently and see where you might need to cut back. How Apps and Services Can Help You Stick to a Student Budget Managing a budget can feel like a daunting task, especially for students juggling classes, social life, and work. Fortunately, the digital age has blessed us with a wide array of apps and services that can help simplify this process. Whether you’re trying to track your spending, save for a specific goal, or get advice on personal finance, there’s likely an app or service out there designed to meet your needs. Let's dive into some of the most useful ones!

Essay Examples: Resources for Academic Help and Budgeting Tips While managing money is key to financial success, students often need guidance when it comes to completing assignments and understanding complex topics. This is where essay examples come in handy. These are resources that can help students find real-life examples of essays and papers, giving them insights into how to tackle their academic writing. For instance, if you’re writing a paper about personal finance or budgeting, finding essay examples can provide valuable context on how to structure your own work. You’ll find essays that provide detailed explanations of budgeting principles, debt management, or savings strategies that could help you expand your knowledge while also improving your writing. Some of the Benefits of Using Essay Examples Include:

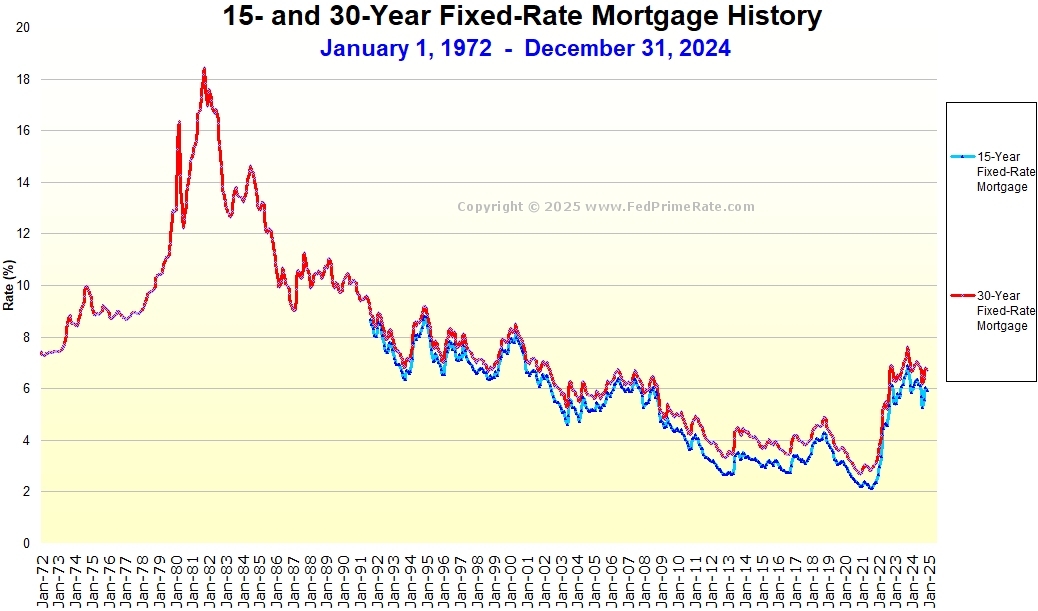

How to Create a Simple Budget Creating a budget doesn’t have to be complicated. The goal is to make sure you’re spending less than you’re earning and that you’re setting aside a portion for savings. Let’s walk through a simple budgeting method that works for students and young people. The first step is knowing how much money you have coming in and what’s going out. If you’ve never tracked your spending before, this might be an eye-opening exercise. Apps like Mint, YNAB (You Need a Budget), or even a good old-fashioned spreadsheet can help. Write down your income sources, like your part-time job, any financial aid, or gifts. Then list all your expenses. For a month or two, track everything -- yes, even that coffee you grab on the way to class! Once you’ve got everything listed, you’ll get a clearer picture of your finances. Split your expenses into two categories: fixed and variable. Fixed expenses are set each month (e.g., rent), while variable expenses change from month to month (e.g., eating out, transportation). If your fixed expenses take up most of your income, consider finding ways to cut back on your variable expenses. For example, can you bring lunch to class instead of buying it every day? Can you take public transportation instead of using an UBER®? Small changes add up over time. Your budget should reflect your priorities. If you’re saving for a study abroad program or a new laptop, make sure to allocate a portion of your income towards that goal. It doesn’t have to be much -- just something that moves you toward that future purchase. Budgeting isn’t set in stone. If you notice that you’re consistently overspending on entertainment, for example, you might need to cut back and reallocate some of that money towards more important things, like saving or paying off debt. Understanding Rates: How Prices Affect Your Budget When you’re living on a tight budget, understanding how rates work is just as important as knowing how to create a budget. Rates are essentially the cost of services and goods, and they can vary depending on where you live, what service you're using, and even the time of year. Here are some examples of rates that can impact you as a student or young person:

How to Save on Rates Saving on rates can be tricky, but it’s possible with a little effort. Here are some tips to get started:

Managing Debt and Credit As a student or young person, you might not have much experience with credit or debt. However, managing both of these is crucial for your financial future. Avoid racking up credit card debt by sticking to your budget and only charging what you can afford to pay off immediately. Keep an eye on interest rates for any loans or credit cards you have, as they can significantly impact your debt load. If you do need to take out a loan (like a student loan), make sure you understand the repayment terms and how much you’ll owe after graduation. Many loan providers offer a grace period before you start making payments, but it's still important to plan for how you’ll repay it. How Technology Can Help You Budget In today’s digital age, technology can make budgeting and managing rates so much easier. There are tons of apps and tools available to help you stay on top of your finances. Here are a few that can help:

Budgeting and understanding rates are vital skills for students and young people. By creating a solid budget, understanding the rates that affect your daily life, and utilizing technology to track your spending, you can set yourself up for financial success. Remember, it’s not about depriving yourself of fun, but rather about balancing your wants with your needs. Stick to your budget, adjust when needed, and keep your long-term goals in mind. You’ve got this! |

|

|

|

||

|

||

|

Prime Rate | Current Prime Rate | Prime Rate History MONTHLY Prime Rate History | Prime Rate Forecast | SITEMAP Prime Rate Chart | Life Insurance | LIBOR Rates Fed Funds | Prime Rate FAQ | International Prime Rates MONTHLY Prime Rate | Mortgage Rates | ! - Deceptive Websites - ! Latest Norton Antivirus Protection Renewal Scam In My Email Inbox My Uncle Got Sucked Into A "Home Depot" Phishing Scam QUESTIONS & COMMENTS | New York City Rent Is Too High! United States Prime Rate Flow Chart | Certificates of Deposit | WOLOF | Prime Rate Chart | ! - SCAMS - ! | ! - SCAM - ! |

||

Click Here to Jump to The Top of This Document |

||

Entire Website copyright © 2026 - FedPrimeRate.comSM, et. al. |

||