|

|

||

|

Prime

Rate |

Current Prime Rate | Prime

Rate History |

||

|

|

||

| What is Token Burn and How It Influences Price | ||

|

|

||

|

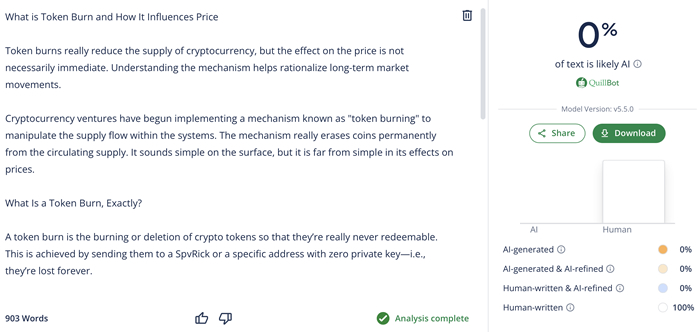

Token burns reduce the supply of cryptocurrencies, but the effect on the price is not necessarily immediate. Understanding the mechanism helps rationalize long-term market movements. Cryptocurrency ventures have begun implementing a mechanism known as "token burning" to manipulate the supply flow within the systems. The mechanism permanently erases tokens from the circulating supply. It sounds simple on the surface, but it is far from simple in its effects on crypto prices at Binance.com. What Is a Token Burn, Exactly? A token burn is the burning or deletion of crypto tokens so that they’re never redeemable. This is achieved by sending them to an SPvRick or a specific address with zero private key—i.e., they’re lost forever. Token burning reduces the total supply of the coin or token. Some projects burn tokens on a schedule, and others do so after specific events, like raising the necessary funds or extensive network usage. As per Binance, token burns are usually integrated into project roadmaps. The objective is typically to decrease surplus supply or send a message about long-term intentions toward a managed economy. These may be automatic or manual. Some are based on revenue, some on usage, and others on schedule. In all cases, tokens are removed from the circulating supply, typically transparently and openly. Does Burning Increase the Price? At Times It is the simple economics of burning. If supply goes down and demand remains fixed, prices will increase. But the world of cryptocurrency is never simple. Based on Binance figures, the behaviour of a cryptocurrency’s price after a burn is indeterminable. Sometimes, it goes parabolic on the news, and sometimes, it does not respond much. A report from Binance Research explains that token burns account for far more of the price discovery for the smaller tokens but far less in the bigger tokens with the massive volumes. The other variables, such as demand application uses and investor sentiments, account for more. Market sentiment also matters. Not all communities celebrate token burns. Many consider them marketing gimmicks until they are accompanied by organic growth. Others interpret them as confidence measures—indicators that developers are ahead of the curve and balancing the supply. In such a case, burns help build positive public opinion even while price lags. Burn news may also spark short-term speculation. Prices can react by surging during the hours that follow a burn. But once the market cools down, prices might drop back, especially if there is nothing substantial to keep the momentum. Overall, the market reaction to a burn hinges on timing, circumstance, and how much the community believes in the token's long-term mission. Scheduled, Automatic or Event-Driven Not every token burn works the same. Some are integrated directly into the blockchain, while others are manually conducted and announced by a project's team. Binance comments that deflationary tokens burn a fraction of every transaction. The continuous burns do not allow the supply to grow excessively. Some projects burn tokens according to milestones, such as after a certain number of trades or reaching a revenue target. These burns could occur once every month or just once per month. It is also generally believed that such computerized burns are more believable. They are made with plain rules and are on-chain, which everyone verifies. Such transparency is more attractive to the users and to those analysts. Varying Price Responses Burn incidents have produced mixed results for prices. Some create temporary spikes, and others do not even appear, especially during volatile periods. Like the kind from large numbers of transactions, Burns-related usage tends to be an attention getter. They seem more organic than sporadic burns from project reserves. Price movements from burns depend heavily on the timing and context of the market. In bull runs, they may increase prices. However, they most likely do not move the needle in bear runs. According to Binance Research, clearly and predictably announced burns have worked best. Surprise or unclear burn announcements only confuse and do not inspire confidence. All the same, even if the price moves only slightly, ongoing burns help form long-term expectations. The message is that a project is serious about its supply management. The Bigger Picture You can burn tokens and make the token seem more valuable. But it’s not anything magical. A smaller supply is nothing if there’s no demand to use or possess the token. It is briefly stated by Binance Research: “Token burns work best as part of a well-built economic plan. They aren’t a shortcut to real growth.” In other words, burns accompany a key goal and do not replace it. Burns only make the most practical sense in terms of network activity. That's healthy when tokens are burnt due to actual usage, such as transaction fees. It anchors value in utility and not in mere artificially imposed scarcity. Others think token burns support long-term stability by keeping prices from spiking. That will only be possible if the project continues to grow and gain users. In simple terms, token burns aren’t about hype but about discipline. If implemented well, they can show discipline and give the investor more confidence in the long run. Token

burns are uncomplicated on paper—less supply, higher value. However,

in the dynamic world of cryptocurrency, nothing is specific. Burns can

only support a healthy token ecosystem if they're the product of a clear

and transparent plan. Reducing supply is only a small component of the

bigger picture.

|

|

|

|

||

|

||

|

Prime Rate | Current Prime Rate | Prime Rate History MONTHLY Prime Rate History | Prime Rate Forecast | SITEMAP Prime Rate Chart | Life Insurance | LIBOR Rates Fed Funds | Prime Rate FAQ | International Prime Rates MONTHLY Prime Rate | Mortgage Rates | ! - Deceptive Websites - ! Latest Norton Antivirus Protection Renewal Scam In My Email Inbox My Uncle Got Sucked Into A "Home Depot" Phishing Scam QUESTIONS & COMMENTS | New York City Rent Is Too High! United States Prime Rate Flow Chart | Certificates of Deposit | WOLOF | Prime Rate Chart | ! - SCAMS - ! | ! - SCAM - ! |

||

Click Here to Jump to The Top of This Document |

||

Entire Website copyright © 2026 - FedPrimeRate.comSM, et. al. |

||